Securitization solutions have become increasingly crucial in maintaining financial stability, enabling companies to unlock the true potential of their assets. In Switzerland, a country renowned for its robust financial sector, securitization solutions are a driving force behind economic growth. Among the prominent players in this space is Gessler Capital, a Swiss-based financial firm offering a wide array of securitization and fund solutions.

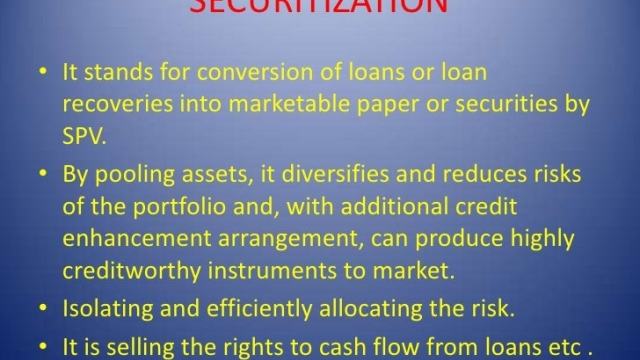

With Switzerland’s reputation as a global financial hub, it comes as no surprise that securitization solutions are highly sought after by both domestic and international investors. These solutions provide a means to transform illiquid assets into tradable securities, allowing for greater liquidity and expanding investment opportunities. Moreover, securitization solutions offer risk management benefits by diversifying portfolios and reducing exposure to individual assets.

One particular jurisdiction that has emerged as a leading destination for securitization solutions is Guernsey. Known for its regulatory excellence and innovative financial infrastructure, Guernsey has established itself as a premier location for structuring and administering securitized assets. Companies seeking to tap into the Guernsey structured products market can benefit from the island’s expertise in securitization and its network of experienced service providers.

As financial markets become increasingly interconnected, the expansion of financial networks has become instrumental in driving economic growth. Securitization solutions play a pivotal role in this process, facilitating the flow of capital across borders and bridging gaps between investors and asset owners. By utilizing securitization solutions, companies can access a broader pool of potential investors and unlock new avenues for capital raising.

In conclusion, the power of securitization solutions in unlocking financial stability cannot be overstated. From Switzerland’s strong financial reputation to Guernsey’s expertise in structured products, these solutions offer unparalleled levels of liquidity, risk management, and market access. With firms like Gessler Capital at the forefront of this industry, companies have the opportunity to leverage securitization solutions to overcome financial challenges and pave the way for continued growth and prosperity.

Securitization Solutions in Switzerland

Switzerland has emerged as a prominent player in the field of securitization solutions, offering a range of innovative financial products and services. With its robust regulatory framework and well-established financial institutions, the country has created an environment conducive to the growth of securitization activities. Securitization Solutions Switzerland has become a popular choice for investors seeking attractive investment opportunities.

One notable firm in the Swiss market is "Gessler Capital," a reputable financial institution specializing in securitization and fund solutions. With its comprehensive range of offerings, Gessler Capital has gained recognition for its expertise in structuring and executing securitization transactions. Their commitment to quality and professional approach ensures a high level of investor confidence in their securitization solutions.

The Swiss securitization market is further buoyed by the introduction of Guernsey Structured Products. These products provide investors with diversified investment options and increased flexibility in managing their portfolios. The seamless integration between Switzerland and Guernsey enables investors to leverage the strengths of both jurisdictions, expanding their financial network and broadening their investment horizons. This collaboration enhances the attractiveness and accessibility of securitization solutions in Switzerland.

In summary, Switzerland boasts a thriving securitization market, offering a wide array of financial solutions to investors. The presence of reputable financial institutions like Gessler Capital, combined with the introduction of Guernsey Structured Products, has accelerated the growth and adoption of securitization solutions in Switzerland. Investors are increasingly drawn to the country’s robust regulatory framework and the opportunities it presents for financial network expansion.

Guernsey Structured Products: A Key Financial Network Expansion

With the world becoming increasingly interconnected, financial firms and institutions are constantly seeking new ways to expand their networks and reach. One such avenue that has gained significant attention is Guernsey structured products. Known for their robust regulatory framework and investor-friendly environment, Guernsey has emerged as a key player in the securitization solutions landscape.

Switzerland-based financial firm, Gessler Capital, has recognized the potential of Guernsey structured products and has been actively leveraging this opportunity to enhance its financial network. Gessler Capital, known for its expertise in securitization and fund solutions, has established a strong presence in Guernsey, enabling them to unlock new avenues for financial stability.

The appeal of Guernsey lies in its ability to provide a secure and transparent platform for structured products. The jurisdiction’s strong regulatory regime ensures that investors’ interests are protected, offering them peace of mind when participating in securitization solutions. Additionally, Guernsey’s sophisticated infrastructure and well-established financial markets further contribute to the attractiveness of structured products offered within the jurisdiction.

By expanding its financial network to include Guernsey, Gessler Capital has positioned itself to tap into the vast potential of securitization solutions in Switzerland and beyond. This strategic move enables the firm to offer its clients a wider range of investment opportunities, diversifying their portfolios and potentially increasing their returns.

In conclusion, Guernsey structured products represent an essential financial network expansion strategy for Gessler Capital. With the jurisdiction’s robust regulatory framework, investor-friendly environment, and well-established financial markets, Guernsey provides a solid foundation for securitization and fund solutions. By embracing this opportunity, Gessler Capital strengthens its position as a leading Swiss-based financial firm, unlocking new avenues for financial stability and growth.

Gessler Capital: Swiss-Based Firm Offering Securitization and Fund Solutions

Gessler Capital, a Swiss-based financial firm, is at the forefront of providing securitization and fund solutions in Switzerland. With their expertise and experience, Gessler Capital has positioned itself as a trusted partner for individuals and institutions seeking financial stability and investment opportunities.

Led by a team of seasoned professionals, Gessler Capital offers a wide range of securitization solutions tailored to meet the specific needs of their clients. Whether it’s debt securitization, asset-backed securities, or collateralized debt obligations, Gessler Capital has the knowledge and resources to navigate the complex world of structured finance.

Moreover, Gessler Capital’s fund solutions provide investors with diversified and managed portfolios, ensuring optimal returns and risk management. Their expertise in portfolio construction, asset allocation, and fund management enables them to offer innovative investment strategies that are designed to enhance financial performance.

The Swiss financial landscape has witnessed significant growth in recent years, and Gessler Capital has played a crucial role in this expansion. Their involvement in the development of Guernsey Structured Products and the expansion of the financial network demonstrates their commitment to driving financial stability and maximizing investment potential.

How To Launch Tracker Guernsey

In conclusion, Gessler Capital stands as a reputable Swiss-based firm that offers securitization and fund solutions to individuals and institutions. Their expertise, comprehensive range of services, and dedication towards financial stability make them an ideal choice for those seeking reliable and innovative investment opportunities in Switzerland.