When it comes to insurance marketing, the art lies in the ability to effectively communicate the value and benefits of insurance to potential customers. In a rapidly evolving digital landscape, where consumers are bombarded with advertisements from various industries, insurance companies must find innovative ways to capture attention and stand out from the crowd.

At its core, insurance marketing is about building trust and establishing a connection between the insurance provider and the consumer. Gone are the days of solely relying on traditional marketing methods. Today, successful insurance marketing involves a strategic blend of traditional tactics and cutting-edge digital strategies.

In this article, we will explore some key strategies for insurance marketing success. From understanding the target audience and identifying their pain points, to leveraging social media platforms and data analytics, we will dive into the essential techniques that can help insurance companies reach their goals and cultivate long-lasting customer relationships. Join us as we unveil the art of insurance marketing and discover the strategies that can set you on the path to success.

Understanding Your Target Audience

To succeed in insurance marketing, it is crucial to have a deep understanding of your target audience. By knowing exactly who you are targeting, you can tailor your marketing strategies to effectively reach and engage potential customers. Here are some key aspects to consider when understanding your target audience:

Demographics: Start by analyzing the demographic characteristics of your target audience. Consider factors such as age, gender, location, income level, and occupation. Understanding the demographic profile will help you craft marketing messages that resonate with the specific needs and interests of your target audience.

Needs and Pain Points: It’s important to identify the needs and pain points of your target audience. What are the challenges they are facing? What are their priorities and aspirations? By addressing these needs and pain points in your marketing campaigns, you can position your insurance offerings as solutions that genuinely benefit your potential customers.

Communication Preferences: Knowing how your target audience prefers to communicate is essential for effective marketing. Some customers might prefer traditional channels like email or phone calls, while others might be more responsive to social media or mobile applications. Understanding their preferred channels will allow you to deliver your message through the right platforms for maximum impact.

By gaining a comprehensive understanding of your target audience, you can develop personalized and relevant marketing strategies that resonate with potential customers. This understanding will form the foundation of your insurance marketing efforts, increasing your chances of success in reaching and engaging your desired audience.

Creating a Strong Brand Identity

In the competitive landscape of insurance marketing, establishing a strong brand identity is crucial for success. A distinctive brand helps insurance companies differentiate themselves from their competitors and build trust with their target customers.

Firstly, clarity is key when it comes to defining your brand identity. Clearly communicate your company’s mission, values, and unique selling proposition to your audience. By understanding what sets your insurance services apart, you can effectively convey your brand message to potential customers.

Secondly, consistency plays a vital role in building a strong brand identity. Your messaging, visuals, and tone of voice should consistently align with your brand’s personality across all marketing channels. Whether it’s your website, social media platforms, or advertisements, maintaining a consistent brand image helps create a recognizable and trustworthy presence in the market.

Lastly, engaging with your audience is crucial for solidifying your brand identity. Listen to your customers’ needs and concerns, and ensure that your insurance products and marketing efforts address these effectively. By actively interacting with your target market and providing valuable content, you can foster a sense of brand loyalty and cultivate a positive brand image.

In conclusion, crafting a strong brand identity is vital for insurance marketing success. By defining your unique brand message, maintaining consistency across all touchpoints, and actively engaging with your audience, you can establish a reputable and recognizable brand in the competitive insurance industry.

Implementing Effective Digital Marketing Tactics

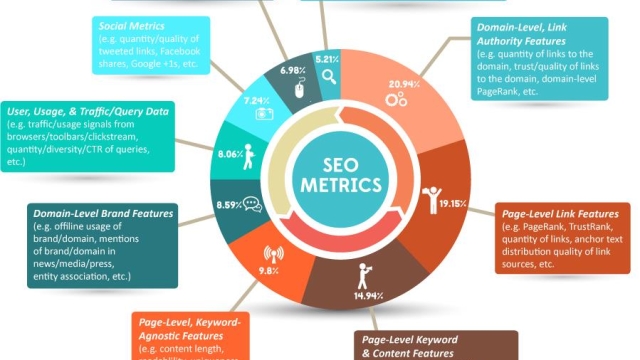

In the rapidly evolving digital landscape, insurance companies must stay ahead of the curve to effectively market their services. By implementing various digital marketing tactics, insurers can enhance their visibility, engage with their target audience, and ultimately drive business growth. Here are three strategies that have proved successful for insurance marketers:

Apartment Owner Insurance In California

Optimize Your Website: A well-designed and user-friendly website is crucial for attracting and retaining potential customers. Optimize your website by ensuring it is mobile-friendly, loads quickly, and offers a seamless browsing experience. Incorporate relevant keywords related to insurance marketing throughout your website content to improve search engine rankings. Remember to provide valuable information, such as policy details, FAQs, and informative blog posts, to establish your credibility and educate visitors about your offerings.

Leverage Social Media: Social media platforms present an excellent opportunity to connect with your target audience and showcase your insurance products. Identify the platforms your potential customers frequent and create engaging content that addresses their pain points and interests. Share valuable tips and insights related to insurance, participate in relevant discussions, and respond promptly to inquiries or comments. Remember to maintain a consistent brand voice across all social media channels and regularly measure the effectiveness of your campaigns to optimize your strategy.

Invest in Search Engine Marketing (SEM): Search engine marketing allows insurers to display targeted ads to users actively searching for insurance-related keywords. By allocating a portion of your marketing budget to SEM, you can increase your visibility on search engine result pages and attract qualified leads. Conduct thorough keyword research to identify the terms and phrases your potential customers are likely to use when searching for insurance products. Craft compelling ad copy and landing pages that effectively communicate the value of your offerings and entice users to take action.

Implementing these digital marketing tactics can significantly bolster your insurance marketing efforts. Remember to monitor your performance regularly, analyze the data, and make necessary adjustments to maximize your return on investment. By staying agile and adapting to changing consumer behaviors, you can maintain a competitive edge in the insurance industry.