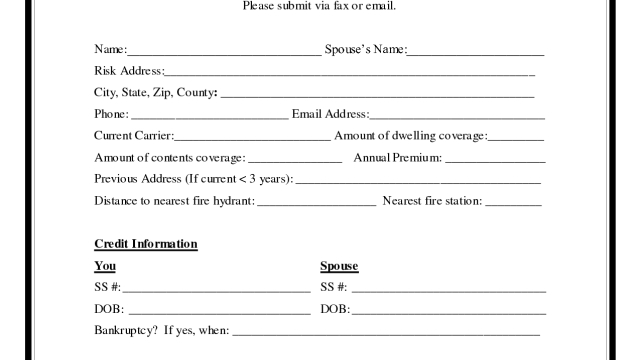

Welcome to the ultimate guide to protecting your haven with homeowners insurance! As a homeowner, one of the most crucial investments you can make is ensuring the safety and security of your abode. This is where homeowners insurance comes into play. Whether it’s unexpected damages, natural disasters, or unfortunate accidents, having the right coverage can provide you with peace of mind and financial protection.

While car insurance and auto insurance are essential for safeguarding your automobile, homeowners insurance encompasses a broader range of protection for your dwelling. It goes beyond just the physical structure of your home and extends to your personal belongings, liability coverage, and additional living expenses in case you need to temporarily relocate due to an unforeseen event. With the right homeowners insurance policy, you can shield yourself from potential financial burdens and ensure that the place you call home remains a sanctuary for you and your loved ones. So, let’s dive deeper into the intricacies of homeowners insurance and explore how it can serve as an invaluable shield for your haven.

Understanding Homeowners Insurance

Homeowners insurance is an essential safeguard for your property, providing financial protection in case of unexpected events that could potentially damage or destroy your home. This comprehensive insurance coverage extends beyond just your physical dwelling and includes your personal belongings, liability protection, and additional living expenses in case your home becomes uninhabitable.

One important aspect of homeowners insurance is its ability to cover various perils that could pose a threat to your property. These perils can include fire, theft, vandalism, or damage caused by severe weather conditions such as storms, hail, or tornadoes. It’s crucial to carefully review your policy to understand the specific perils covered to ensure you have adequate protection for your home and possessions.

In addition to protecting your home itself, homeowners insurance can also extend coverage to other structures on your property, such as sheds, garages, or fences. This coverage extends not only to the physical structures but also to the items stored within them. It’s essential to properly evaluate the value of these structures and their contents to ensure you have sufficient coverage in case of loss or damage.

While homeowners insurance provides coverage for your property, it also includes liability protection. This means that if someone is injured on your property, your insurance policy may help cover the medical expenses or legal costs if you are found liable. Liability coverage can also extend beyond your property, giving you peace of mind even when accidents happen outside your home.

Understanding the basics of homeowners insurance is the first step towards protecting your haven. By having a comprehensive policy that covers your dwelling, personal belongings, liability, and additional living expenses, you can have peace of mind knowing that you have financial protection in place to handle unexpected events. Consult with an insurance professional to ensure you select a policy that suits your specific needs and provides adequate coverage for your home.

The Importance of Car Insurance

Car insurance plays a crucial role in protecting both you and your vehicle from unforeseen events on the road. Having the right coverage can provide you with peace of mind and financial security in case of accidents, theft, or damage to your car. In this section, we will explore the importance of car insurance and why it is essential for every driver.

First and foremost, car insurance provides protection against potential financial liabilities. Accidents happen, and when they do, the cost of repairs, medical bills, and legal fees can quickly add up. With the right car insurance policy, you won’t have to bear these expenses alone. Instead, your insurance provider will step in and cover a significant portion, if not all, of the costs, depending on your coverage limits.

Secondly, car insurance offers protection against theft or damage to your vehicle. Being a victim of car theft or vandalism can be a distressing experience, both emotionally and financially. However, having comprehensive car insurance can ease the burden by compensating you for the value of your stolen or damaged vehicle. This can help you get back on the road without having to face significant financial setbacks.

Lastly, car insurance is not just about protecting your own vehicle; it also provides coverage for third-party damages. If you are at fault in an accident that causes damage to someone else’s car or property, your car insurance can cover the costs associated with repairing or replacing it. This not only protects you from potential lawsuits but also ensures that other individuals involved in the accident receive the necessary compensation for their losses.

In conclusion, car insurance is vital for any driver as it provides financial protection, covers damages to your vehicle, and offers liability coverage for third-party damages. As the saying goes, it’s better to be safe than sorry, and having the right car insurance policy ensures that you are prepared for any unexpected events on the road.

Choosing the Right Auto Insurance

auto insurance grand rapids mi

When it comes to choosing the right auto insurance, there are a few important factors to consider. Firstly, you’ll want to assess your specific needs and preferences. Take into account the type of vehicle you own, your driving habits, and the level of coverage you require. By understanding what you need from your auto insurance policy, you can make a more informed decision.

Next, it’s crucial to compare different auto insurance providers. Look for reputable companies with a proven track record of customer satisfaction. Consider their financial stability and the range of coverage options they offer. Reading customer reviews and seeking recommendations can also help you gauge the quality of service provided by various insurers.

Lastly, don’t forget to take costs into consideration. While it’s important to find an affordable policy, remember that cheaper isn’t always better. You’ll want to strike a balance between cost and coverage to ensure you get adequate protection. Consider factors such as deductibles, premiums, and any additional benefits or discounts offered.

By following these steps and taking the time to research and compare auto insurance providers, you can make an informed choice that suits your specific needs and provides you with the peace of mind you deserve when out on the road. Remember, your auto insurance should be tailored to your individual circumstances and preferences, so don’t rush the decision-making process.