Welcome to your ultimate guide to home insurance! Protecting your home is of utmost importance, as it is not only a place where you seek comfort and security but also a significant investment. With so many potential risks and uncertainties in life, having the right insurance coverage can provide you with the necessary peace of mind. In this article, we will explore the ins and outs of home insurance, including contractor insurance, general liability insurance, bonds insurance, and workers comp insurance. By understanding the different types of coverage available, you’ll be better equipped to safeguard your haven from unforeseen events and protect yourself financially. So, let’s dive in and navigate the world of home insurance together!

1. Understanding Home Insurance

In this section, we will delve into the world of home insurance and explore the vital aspects you need to grasp. Whether you are a homeowner, a renter, or even a landlord, having a comprehensive understanding of home insurance can bring you peace of mind and financial security.

Home insurance serves as a protective shield against unforeseen events that may damage or disrupt your home and its contents. It goes beyond just safeguarding your physical dwelling; it also covers personal belongings and liability protection. By opting for home insurance, you mitigate the risks associated with natural disasters, theft, fire, and other potential hazards.

Contractor insurance plays a pivotal role in the realm of home insurance. When undertaking construction or renovation projects, it is crucial to ensure that your contractor is adequately covered with liability insurance. In the unfortunate event of accidents or property damage during construction, contractor insurance provides the financial protection required to resolve any potential disputes.

Another essential element to consider is general liability insurance. This insurance protects homeowners against claims resulting from injuries or accidents that occur within their premises. Whether it’s a slip and fall incident or an injury due to negligence, having general liability insurance helps mitigate the financial burden that may arise from potential lawsuits.

Furthermore, bonds insurance is a critical aspect of home insurance, specifically for homeowners hiring contractors. Bonds insurance acts as a guarantee against incomplete or substandard work. It ensures that homeowners are safeguarded in case the contractor fails to fulfill their obligations, including meeting deadlines or providing quality workmanship.

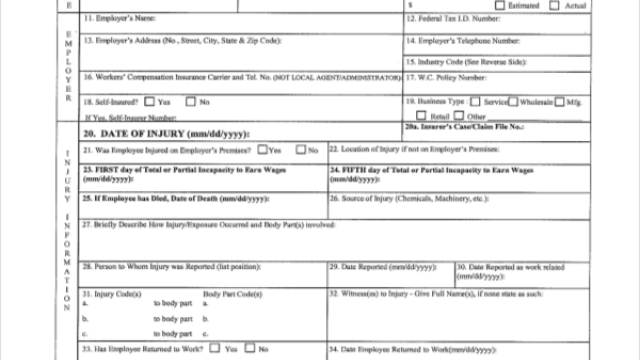

Lastly, workers’ comp insurance is an integral component of home insurance when hiring contractors or workers for home-related projects. Workers’ comp insurance covers medical expenses and wage replacement for workers injured during their employment. By having workers’ comp insurance, homeowners protect themselves from potential lawsuits or financial obligations resulting from workplace accidents.

In the next sections, we will explore home insurance coverage options, how to choose the right policy, and tips for optimizing your home insurance to ensure maximum protection for your haven. Stay tuned for valuable insights! Stay tuned for valuable insights!

2. Protecting Your Home with Additional Coverage

When it comes to safeguarding your haven, having just standard home insurance may not always be enough. It is important to consider additional coverage options that can provide you with an extra layer of protection. Here are three types of coverage you should consider:

Contractor Insurance:

If you’re planning to undertake any major renovations or hire contractors for any home improvement projects, it is crucial to make sure they have contractor insurance. This insurance coverage protects you in case of any damages or injuries that may occur during the construction process. It provides you with peace of mind knowing that you won’t be held liable for any unforeseen accidents that may happen on your property.General Liability Insurance:

General liability insurance is another important additional coverage you should consider for your home. This type of insurance provides protection in case someone sues you for bodily injury or property damage that occurred on your property. Whether it’s a slip and fall accident or damage caused by your pet, having general liability insurance can save you from unexpected financial consequences and legal troubles.Bonds Insurance:

Workers Comp Insurance Michigan

When hiring contractors or service providers, it’s wise to ensure they are bonded. Bonds insurance serves as a guarantee that the contractor will complete the project according to the agreed-upon terms. If the contractor fails to deliver or fulfill their obligations, the bonds insurance can provide compensation or cover any financial losses you may incur. This additional coverage gives you added reassurance when hiring professionals to work on your home.Workers Comp Insurance:

If you hire workers, such as housekeepers or gardeners, it is essential to have workers compensation insurance. This coverage protects you in case any of your employees get injured while working on your property. It provides financial support for their medical expenses and lost wages, while also shielding you from any potential lawsuits related to the injury.

By considering these additional coverage options, you can ensure that your home is well-protected in various situations. It’s always better to be prepared and have that extra layer of security for your haven.

3. Insurance for Contractors and Workers

When it comes to home insurance, it’s not just about protecting your property, but also the people who work on it. That’s where insurance for contractors and workers comes into play. Whether you’re hiring a general contractor, a remodeling specialist, or any other professional to work on your home, it’s crucial to ensure they have the right insurance coverage in place.

Contractor insurance, also known as general liability insurance, is designed to safeguard both you and the contractor from potential liability claims. This coverage protects against property damage, bodily injury, and other accidents that may occur during the construction or renovation process. It’s essential for contractors to have this insurance in order to provide peace of mind to homeowners like yourself.

In addition to general liability insurance, contractors should also have bonds insurance. Bonds serve as a form of protection for homeowners in case the contractor fails to fulfill their contractual obligations or defaults on the project. This type of insurance ensures that you won’t be left hanging if something goes wrong, as the bond can provide financial compensation or assistance to complete the project.

Lastly, workers’ comp insurance is crucial for protecting the workers themselves. It covers medical expenses, lost wages, and rehabilitation costs if an employee gets injured or becomes sick while working on your property. By requiring contractors to have workers’ comp insurance, you not only protect their well-being but also shield yourself from potential lawsuits in case of any workplace accidents.

In conclusion, when hiring contractors for your home projects, make sure they have the necessary insurance coverage. Contractor insurance, bonds insurance, and workers’ comp insurance are essential safeguards for both you and the workers involved. With these protections in place, you can have peace of mind knowing that your haven is protected against unforeseen circumstances.